Institutional-grade tokenized

commodities for regulated investing

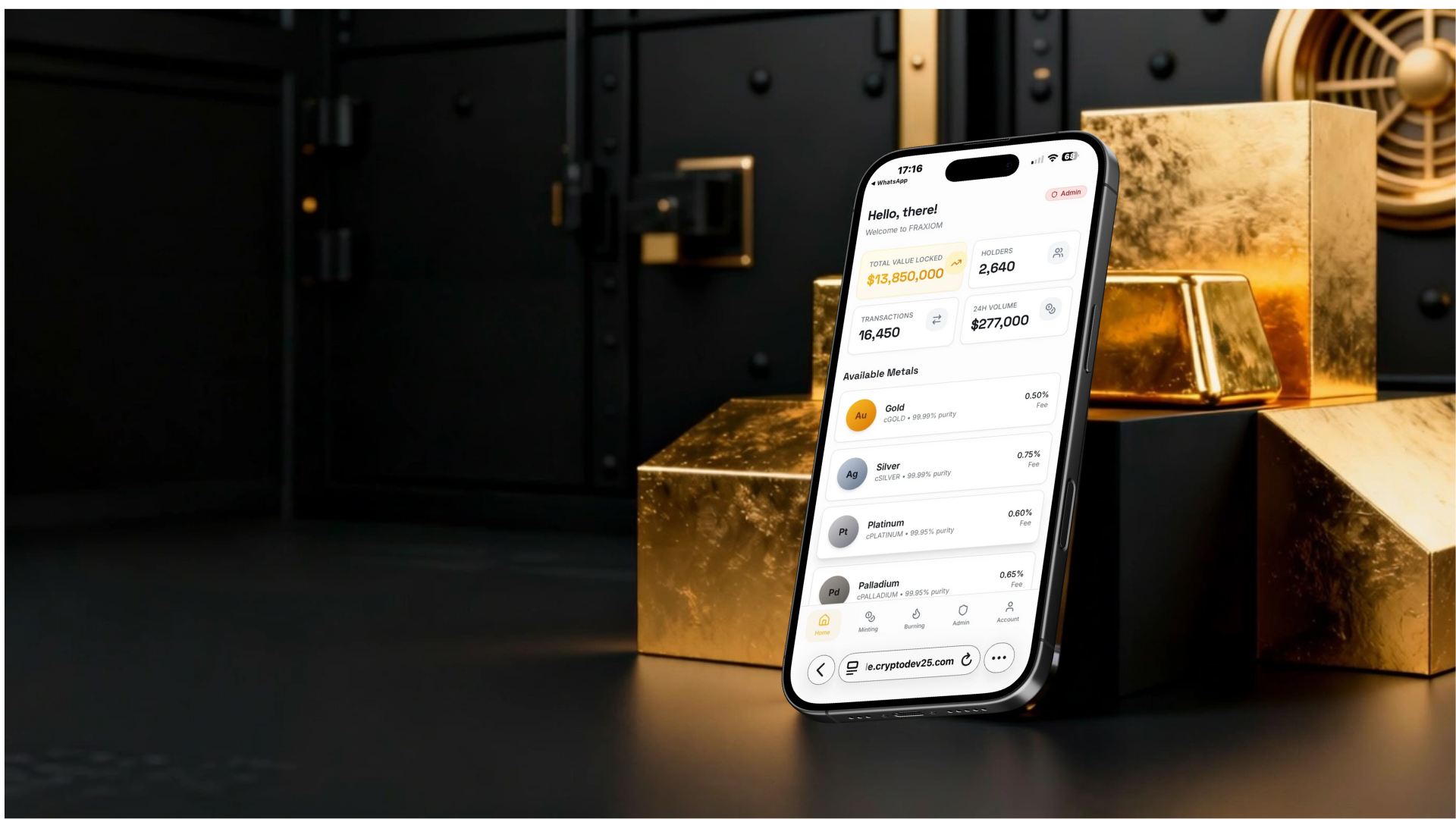

FRAXXIOM

Fractional exposure to verified metals,

backed by audited physical assets and

U.S -compliant custody structures.

Available exclusively to accredited

and qualified investors.

Built on verified assets and institutional-grade custody

U.S. Compliant Custody

Assets are held under segregated custodial structures aligned with U.S. regulatory, security, and reporting standards.

Independently audited assets

Underlying inventories are subject to recurring third-party audits validating existence, ownership, and chain of custody.

Blockchain-based traceability

Ownership records and asset provenance are immutably recorded on-chain, enabling independent verification.

Fractional ownership by design

Structured exposure to real-world commodities without operational or extraction involvement.

CUSTODY

AUDIT

LEGAL

BLOCKCHAIN

Designed for risk-aware investors

What You Can Invest In

No rehypothecation or synthetic exposure

1:1 backing between tokens and physical inventory

Emission strictly tied to verified custody events

Gold

A globally recognized store of value with deep liquidity and long-term demand, used for portfolio stability and inflation protection.

Platinum

A strategic precious metal with critical industrial applications, particularly in automotive and clean energy technologies.

Rhodium

A rare, high-value metal primarily used in advanced catalytic systems, characterized by limited supply and specialized demand.

Ruthenium

A specialty metal used in electronics, semiconductors, and advanced manufacturing, valued for its durability and conductive properties.

Lithium

A critical material for energy storage and electrification, essential to battery technology and the global energy transition.

Palladium

A widely used precious metal in emission control systems and electronics, offering exposure to industrial demand cycles.

“Gold bug” is an informal financial term used to describe an individual or group of investors with a strong and persistent conviction in gold as a core asset for capital preservation and long-term value accumulation.

What it means in practical terms

A gold bug believes that:

Gold is the most effective hedge against inflation, financial crises, and currency devaluation.

Fiat currencies (USD, EUR, etc.) structurally lose purchasing power over time.

The traditional financial system is inherently fragile or unsustainable in the long run.

Gold will ultimately appreciate significantly relative to financial assets.

This is not a short-term tactical position, but rather a long-term ideological and strategic investment stance.

How Fraxxiom Works

Asset verification

Assets are legally sourced, title-verified, independently audited, and documented prior to any token issuance.

Digital representation

Token issuance occurs only after physical inventory is deposited in certified custody, ensuring 1:1 asset backing.

Secure access

Investor access is gated through KYC/AML, eligibility verification, and controlled onboarding processes.

Start your institutional evaluation

Schedule a private demo

Request access to legal documentation

Discuss custody and compliance